Category: Stocks and Investing

Category: Humor and Quirks

Category: Business and Finance

Category: Humor and Quirks

Category: Media and Entertainment

Category: Automotive and Transportation

Category: Automotive and Transportation

Category: Automotive and Transportation

Category: Politics and Government

Category: Automotive and Transportation

Category: Sports and Competition

Category: Politics and Government

Category: Sports and Competition

Category: Food and Wine

Category: Business and Finance

Category: Media and Entertainment

Category: Business and Finance

Category: Automotive and Transportation

Category: Automotive and Transportation

Category: Automotive and Transportation

Category: Business and Finance

Category: Business and Finance

Category: Food and Wine

Category: House and Home

Category: Business and Finance

Category: Travel and Leisure

Category: Politics and Government

Category: Politics and Government

Category: Politics and Government

Category: Politics and Government

Category: Politics and Government

Category: Politics and Government

Category: Travel and Leisure

Category: Politics and Government

Category: Politics and Government

Category: Politics and Government

Category: Politics and Government

Category: Politics and Government

Category: Automotive and Transportation

Stocks and Crypto Converge: A New Investment Era

Locales: THAILAND, UNITED STATES

The Convergence of Traditional and Digital Finance

Thursday, January 22nd, 2026 marks a pivotal moment in the evolution of investment strategies. The once-distinct worlds of traditional stocks and cryptocurrencies have increasingly intertwined, creating a complex but potentially rewarding landscape for investors. As we move further into the 2020s, understanding how to effectively combine these asset classes is becoming essential for building a robust and future-proof portfolio.

A Shifting Investment Landscape

The financial ecosystem in 2026 reflects a global shift toward digital assets. While traditional stocks remain a cornerstone of most portfolios, offering stability and established growth patterns, cryptocurrencies have matured beyond the early hype, finding a more defined place in the investment spectrum. The volatility remains a significant factor, but increased institutional interest and the development of more sophisticated crypto infrastructure have contributed to a degree of predictability.

Stocks: The Enduring Foundation

Sectors like technology, renewable energy, and healthcare continue to be primary drivers of stock market growth, showcasing the continued importance of long-term, stable investments. In 2026, we are seeing a broader emphasis on ESG (Environmental, Social, and Governance) factors influencing stock selection, with investors prioritizing companies committed to sustainable practices. Dividend-paying stocks are also experiencing a resurgence as investors seek income in a period of moderate inflation.

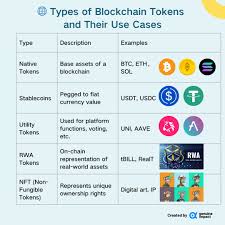

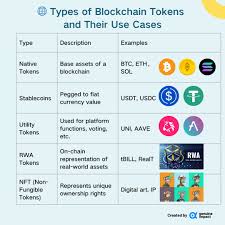

Cryptocurrencies: Maturation and Regulation

Cryptocurrencies like Bitcoin and Ethereum have transitioned from speculative assets to increasingly recognized investment vehicles. The regulatory environment has become more defined, although it still presents challenges. Layer-2 solutions and decentralized finance (DeFi) applications are further refining the crypto space, offering investors more opportunities for yield and engagement. However, security and scalability concerns remain important considerations.

Strategic Approaches to Combining Stocks and Crypto

The key to successful integration lies in tailoring your approach to your individual circumstances and financial objectives. Here's a breakdown of some key strategies:

1. Diversification: The Baseline Strategy

The most widely adopted approach is a diversified portfolio, typically allocating 70-80% to stocks and 20-30% to cryptocurrencies. This represents a balance between the stability of the stock market and the potential for higher returns from crypto. Experienced financial advisors are now routinely incorporating crypto into broader portfolio construction for clients with varying risk profiles.

2. Risk-Adjusted Allocation

Conservative investors might choose a more cautious approach, limiting crypto exposure to 5-10% of their portfolio. This minimizes risk while allowing for some participation in the digital asset market. Conversely, those with a higher risk tolerance, particularly younger investors, may allocate up to 50% or more to crypto, understanding the inherent volatility. Sophisticated strategies involve dynamic asset allocation, shifting between stocks and crypto based on real-time market conditions and predictive analytics.

3. Dollar-Cost Averaging (DCA): Mitigating Volatility

DCA remains a cornerstone of many crypto investment strategies. By investing a fixed amount at regular intervals, investors avoid the emotional trap of timing the market and smooth out purchase prices. This is particularly effective in the volatile crypto market, mitigating the impact of short-term fluctuations.

4. Growth and Value Synergy

This strategy involves aligning your investments based on growth potential. Invest in growth stocks for long-term appreciation and then allocate a portion of your portfolio to crypto for high-growth opportunities. Alternatively, invest in value stocks for a stable base and consider crypto as a vehicle for speculative gains.

Key Considerations for 2026

- Risk Assessment: Understanding your risk tolerance is paramount. Crypto's volatility necessitates a comfortable loss threshold.

- Financial Goals: Your investment horizon (retirement, down payment, etc.) will dictate asset allocation.

- Tax Implications: The tax treatment of stocks and crypto differs significantly; expert advice is recommended to optimize tax efficiency.

- Regulatory Awareness: Constant monitoring of the evolving crypto regulatory landscape is crucial for informed decision-making. Recent regulatory clarity surrounding stablecoins has provided some stability to the market.

- Security: With increased adoption, cybersecurity remains a top priority. Secure storage solutions and robust authentication methods are essential.

Looking Ahead: The Future of Hybrid Investing

The convergence of stocks and crypto is more than a trend; it's a fundamental shift in the financial landscape. As institutions increasingly embrace digital assets and technological advancements continue to refine the crypto space, we can anticipate even greater integration of these asset classes in investment strategies. The ability to navigate this evolving landscape will be a key differentiator for investors in the years to come.

Read the Full The Thaiger Article at:

[ https://thethaiger.com/guides/finance/how-to-combine-stocks-and-crypto-in-2026-investment-strategies ]

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing