Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Automotive and Transportation

Category: Automotive and Transportation

Category: Stocks and Investing

Category: Stocks and Investing

Category: Business and Finance

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Food and Wine

Category: Humor and Quirks

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: House and Home

Category: Stocks and Investing

Category: Stocks and Investing

Category: House and Home

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Buffett's Transition: 6-Year Returns on Berkshire Hathaway

Finbold | Finance in Bold

Finbold | Finance in BoldLocales: Nebraska, UNITED STATES

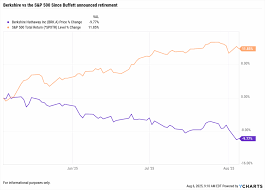

Tuesday, March 3rd, 2026 - The financial world marked a significant moment in May 2020 when Warren Buffett, the 'Oracle of Omaha,' began signaling a gradual transition away from his leadership roles at Berkshire Hathaway (BRK.A, BRK.B). While not a sudden departure, the announcement sparked intense scrutiny of the company's future trajectory and the potential performance of its stock. Today, as of March 3rd, 2026, we revisit that pivotal moment, examining the returns on a $1,000 investment made in Berkshire Hathaway around the time of that initial transition news and projecting what the future might hold under new leadership.

A $1,000 Investment: From 2020 to 2026

As previously reported, an investor who committed $1,000 to Berkshire Hathaway (BRK.A) shares in May 2020 would currently see that investment valued at approximately $2,316.98 (as of March 3, 2026). This translates to a gain of over 131.69% in roughly six years. While not exponential growth, it demonstrates a consistently strong and reliable return, significantly outpacing many other investments during a period marked by economic volatility, including the initial COVID-19 downturn, inflation spikes, and geopolitical uncertainty.

However, it's crucial to contextualize this growth. The initial phase of this period (2020-2021) witnessed a dramatic market rebound following the pandemic-induced crash. Berkshire Hathaway, with its conservative approach and strong holdings in sectors like insurance, railroads, and energy, was well-positioned to capitalize on this recovery. The subsequent years saw more moderate, but still positive, growth, even amidst rising interest rates and inflationary pressures.

BRK.A vs. BRK.B: A Reminder for Investors

For those unfamiliar with Berkshire Hathaway's stock structure, it's essential to understand the distinction between BRK.A and BRK.B shares. BRK.A shares, historically the first class issued, carry voting rights and command a significantly higher price per share - currently exceeding $500,000. This makes them inaccessible to most individual investors. BRK.B shares, created in 1996, were designed to broaden access to the company. These shares have no voting rights but trade at a much lower price (currently around $350), making them the preferred choice for the vast majority of investors. An investor choosing BRK.B shares in May 2020 would have also seen a similar percentage increase, though the exact dollar figure would differ due to the share split.

The Buffett Premium: Has it Dissipated?

The question many investors have been pondering since the announcement of Buffett's transition is whether the 'Buffett premium' - the extra value attributed to his leadership - has been factored out of the stock price. There's evidence to suggest this is happening. While Berkshire Hathaway continues to perform well, the rate of growth has slightly moderated in the last two years compared to the peak years under Buffett's sole command. This is partially attributable to the sheer size of Berkshire Hathaway; compounding returns becomes more challenging with a larger asset base. Furthermore, Greg Abel, now the CEO, is implementing his own strategic initiatives, while remaining true to the core principles of value investing.

Looking Forward: Abel's Berkshire and Potential Growth Drivers

Greg Abel's leadership is now being thoroughly evaluated. His focus on deploying capital into renewable energy, a sector Buffett was previously hesitant to fully embrace, could prove to be a significant growth driver in the coming years. Berkshire's substantial cash reserves ($approximately $160 billion as of Q4 2025) provide Abel with ample opportunity to make strategic acquisitions. Analysts are closely watching for potential moves in sectors like technology and healthcare, where Berkshire has historically been underweight.

The company's existing portfolio also provides a solid foundation. BNSF Railway continues to be a vital component of the North American transportation network. Berkshire's insurance businesses, including GEICO and General Re, remain highly profitable, although facing increasing competition from insurtech startups. Investments in companies like Apple, Coca-Cola, and Bank of America continue to generate substantial dividends.

Is Berkshire Hathaway Still a Buy?

Despite the transition in leadership and the current market environment, Berkshire Hathaway remains a compelling long-term investment. Its diversified portfolio, strong balance sheet, and commitment to value investing provide a degree of resilience that many companies lack. However, investors should be realistic about future returns. The days of consistently outperforming the market by a wide margin may be over, but a steady and reliable return on investment remains highly probable. A $1,000 investment made today will likely see similar, though perhaps slightly reduced, gains over the next six years, provided the company continues to execute its strategy effectively.

Read the Full Finbold | Finance in Bold Article at:

[ https://finbold.com/1000-invested-in-berkshire-stock-when-warren-buffett-retired-is-now-worth-this-much/ ]

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing