Category: House and Home

Category: Stocks and Investing

Category: Business and Finance

Category: Stocks and Investing

Category: Stocks and Investing

Category: House and Home

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Business and Finance

Category: Business and Finance

Category: Business and Finance

Category: Stocks and Investing

Category: Stocks and Investing

Category: Business and Finance

Category: Business and Finance

Category: Stocks and Investing

Category: Travel and Leisure

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Food and Wine

Category: Stocks and Investing

Category: Stocks and Investing

Category: House and Home

Category: Stocks and Investing

Category: Travel and Leisure

Category: Stocks and Investing

Category: Stocks and Investing

Category: Science and Technology

Category: Stocks and Investing

Category: Food and Wine

Category: Travel and Leisure

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Travel and Leisure

Category: Stocks and Investing

Category: Stocks and Investing

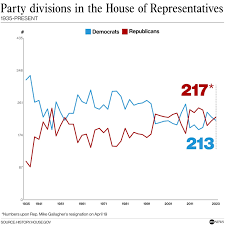

Republican Party Divided Over Economic and Foreign Policy

Locales: New York, Washington, California, UNITED STATES

Washington D.C. - February 16, 2026 - This week's round of Sunday talk shows served as a stark illustration of the fractures within the Republican party, as leading figures clashed over approaches to a volatile global economy and increasingly complex foreign policy challenges. The conversations underscored a party wrestling with its identity as it prepares for the crucial midterm elections, revealing a lack of unified vision on issues ranging from domestic fiscal policy to international aid and geopolitical strategy.

The most prominent theme emerging from the interviews was the deep internal disagreement regarding economic policy. While a core tenet of the Republican platform has traditionally been fiscal conservatism - reduced government spending and limited intervention - a growing contingent acknowledges the necessity of strategic investment in certain sectors to address ongoing economic headwinds. The persistent issue of inflation remains a central concern, yet viewpoints diverge sharply on the most effective methods for taming it. Some Republicans doubled down on calls for stricter budgetary controls and a reduction in federal programs, arguing that government overspending is a primary driver of inflationary pressures. They advocate for allowing the Federal Reserve greater latitude in implementing contractionary monetary policies, even at the risk of short-term economic slowdown.

However, a newer faction, gaining prominence within the party, argues that simply cutting spending risks stifling economic growth and exacerbating inequalities. They propose targeted investments in infrastructure, renewable energy, and workforce development programs, believing that these areas will yield long-term economic benefits and create opportunities for American workers. This group contends that a more nuanced approach is required, one that balances fiscal responsibility with strategic investment in key industries. The debate highlights a fundamental ideological struggle within the GOP - a tension between traditional conservative principles and a pragmatic recognition of the changing economic landscape.

Foreign policy dominated a substantial portion of the Sunday discussions, with the ongoing conflict in Ukraine taking center stage. The Biden administration's repeated requests for additional aid packages to Ukraine have met with increasing resistance, particularly from a vocal segment of the Republican party. While some staunchly defend continued support for Ukraine, framing it as a crucial stand against Russian aggression and a defense of democratic values, others are questioning the financial and strategic rationale for continued involvement. Concerns were raised regarding the lack of a clear exit strategy and the potential for an open-ended commitment of American resources. Several interviewees suggested a shift towards prioritizing domestic needs and reducing the U.S.'s role as a global "policeman."

The discussion extended beyond Ukraine to encompass the broader geopolitical rivalry with China. Republican leaders universally expressed anxieties regarding China's economic and military expansion, with many advocating for a more assertive U.S. posture. Concerns centered around unfair trade practices, intellectual property theft, and China's growing military presence in the South China Sea. The call for a stronger response to China isn't solely about military might. Many are pushing for reshoring critical manufacturing, reducing reliance on Chinese supply chains, and forging stronger alliances with countries in the Indo-Pacific region. The balancing act between maintaining economic ties with China - a major trading partner - and safeguarding national security represents a significant challenge for policymakers.

Finally, the volatile situation in Gaza and the wider Middle East also received attention. Interviewees offered diverse opinions on the U.S.'s role in mediating the conflict and providing humanitarian assistance. The complexities of the Israeli-Palestinian conflict were repeatedly acknowledged, with little consensus emerging on a path forward. The potential for regional escalation, fueled by proxy conflicts and extremist groups, continues to loom large. Several Republican lawmakers cautioned against a heavy-handed U.S. intervention, arguing that a more measured and diplomatic approach is necessary to prevent further instability.

In conclusion, the Sunday shows painted a picture of a Republican party at a crossroads. Facing internal divisions on critical issues and navigating a turbulent global landscape, the GOP appears to be struggling to articulate a coherent and unified vision for the future. The debates witnessed this weekend are likely to continue and intensify as the election season draws closer, forcing Republicans to confront their ideological differences and ultimately define the direction of the party for years to come.

Read the Full Barron's Article at:

[ https://www.barrons.com/livecoverage/sundayshows1221 ]

Category: House and Home

Category: House and Home

Category: House and Home

Category: House and Home

Category: House and Home

Category: House and Home

Category: House and Home

Category: House and Home

Category: House and Home

Category: House and Home

Category: House and Home

Category: House and Home