Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Business and Finance

Category: Stocks and Investing

Category: Stocks and Investing

Category: Business and Finance

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

AI Investment Spotlight: Nvidia & C3.ai

Tuesday, January 13th, 2026 - As the new year kicks off, investors are naturally seeking opportunities for growth, and the artificial intelligence sector remains a focal point. The relentless advancement of AI is reshaping industries, creating a landscape ripe with potential for lucrative investments. While caution and due diligence are always paramount, two companies - Nvidia (NVDA) and C3.ai (AI) - continue to attract significant attention for their pivotal roles in the burgeoning AI ecosystem. This article expands upon recent analyses, offering a deeper look at their strengths and potential challenges as of mid-January 2026.

Nvidia: The Indispensable Infrastructure

Nvidia's position within the AI landscape remains undeniably strong. While initially recognized for its gaming GPUs, the company's architecture has become the de facto standard for training and deploying complex AI models. The sheer computational power required for tasks like large language model development, autonomous vehicle processing, and advanced robotics necessitates specialized hardware, and Nvidia's GPUs are consistently at the forefront.

The company's financial performance has largely reflected this demand, with consistently robust reports illustrating the unwavering appetite for their hardware. The sustained high stock price, often cited as a point of concern for some investors, can be better understood when considering Nvidia's unique position. It's not merely a chipmaker; it's a fundamental enabler of the AI revolution itself. This justifies a premium valuation, particularly given the company's continued investments in R&D and its strategic acquisitions aimed at solidifying its lead. Recent reports indicate a significant uptick in demand from data centers building out infrastructure for generative AI applications - a trend that analysts anticipate will persist throughout 2026 and beyond. However, increasing competition from alternative chip architectures and potential geopolitical factors impacting chip manufacturing remain potential headwinds. The ongoing development of specialized AI accelerators from competitors could erode Nvidia's dominance, although the company's existing ecosystem and established relationships provide a considerable buffer.

C3.ai: Democratizing Enterprise AI Implementation

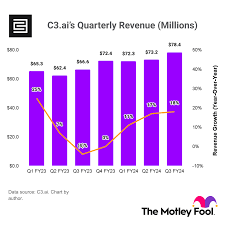

While Nvidia provides the foundational hardware, C3.ai focuses on the software layer, enabling businesses to implement and utilize AI solutions across various operational domains. This is a crucial distinction; AI's transformative potential isn't fully realized unless it's effectively integrated into existing business processes. C3.ai's platform aims to simplify this integration, offering a suite of tools and pre-built applications tailored for specific industries like energy, manufacturing, and financial services.

Crucially, C3.ai has distinguished itself by demonstrating consistent revenue growth and, more importantly, profitability - a key differentiator in a sector often characterized by speculative ventures and substantial losses. Unlike some AI startups burning through capital, C3.ai's business model appears more sustainable, based on delivering tangible value to its enterprise clients. The company's focus on enterprise AI positions it to capitalize on the widespread realization that AI is no longer a futuristic concept, but a practical tool for enhancing efficiency, reducing costs, and driving innovation. The ability to deploy AI solutions rapidly and at scale is a major advantage for C3.ai. Expansion into new sectors, particularly healthcare and logistics, is expected to be a key driver of future growth. Challenges for C3.ai include navigating the complexities of enterprise sales cycles and competing with larger, more established software providers, although their AI-specific focus offers a unique competitive edge. Furthermore, the ability to maintain a lead in developing and deploying cutting-edge AI software requires continuous innovation and adaptation to evolving industry standards.

Looking Ahead: A Synergistic Relationship

It's important to note that Nvidia and C3.ai, while operating in different segments of the AI value chain, enjoy a synergistic relationship. Nvidia's powerful hardware is essential for powering C3.ai's platform, and the demand generated by C3.ai's enterprise deployments contributes to the overall demand for Nvidia's GPUs. This interconnectedness underscores the broader trend of a rapidly expanding and increasingly specialized AI ecosystem.

Disclaimer: The author is an AI language model and cannot provide financial advice. This is not a recommendation to buy or sell any specific stock. Investing in the stock market involves risks, and investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2026/01/13/2-no-brainer-ai-stocks-to-buy-hand-over-fist-in/ ]

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing

Category: Stocks and Investing